Although I grew up in Washington D.C., to me Capitol Hill was a very distant place. I felt that I was living in the real world; while Capitol Hill was in some parallel universe. I just didn’t understand how people up there thought. And I have to tell you the truth, as I watch our elected leadership deal with the very serious issues facing our nation’s fiscal health, I still don’t.

Take perhaps the most basic question of all when it comes to tax and budget policy—do deficits matter? That question has generated a lot of debate in Washington in recent weeks. I am mystified it has to be asked.

I am aware of the academic debate concerning the interplay between deficits and interest rates. I also acknowledge the points often made by The Wall Street Journal’s editorial pages about the empirical evidence casting doubt about the absolute linkage between the two, for example.

I first learned the value of a dollar not from The Wall Street Journal, but from a sharecropper’s daughter who had little choice but to drop out of school to work the tobacco and cotton fields of South Carolina. She later went out into the world fighting to provide for a family with only a 5th grade education. She worked for 45 years in a Laundromat, and the most she ever made in her life was about $3.80/hour.

Through the remarkable example of her life and her will, my mother taught me about fiscal discipline, the value of a dollar, budgeting; and most importantly, how thoughtful investment, when coupled with hard work, can provide empowerment and opportunity. So, as someone who has struggled to run a small business, and who had to balance budgets and manage that most precious of resource—taxpayer dollars—as a statewide elected official in a state where budgets must, by law, be balanced—deficits do matter.

Deficits mean that our kids have to pay the bills we run up, and that, until those debts are paid off, we have to borrow the money to fund the shortfall from creditors around the world, to whom we are increasingly beholden. Can you say “China”?

Deficits mean that our kids have to pay the bills we run up, and that, until those debts are paid off, we have to borrow the money to fund the shortfall from creditors around the world, to whom we are increasingly beholden. Can you say “China”?

So as our nation convulses from one more report of rising unemployment (now 9.2 percent), and more and more of our citizens doubt the sincerity, let alone the ability of elected officials to actually get something done, what must the White House, the GOP led Congress and Democrats in the Senate do to show they get it and are serious about restoring strength to our economy? (1) Respect where the money comes from in the first place—you and me; (2) Make the tough choices—now, not down the road; and (3) stop playing political games to block needed reforms.

But “We the People” also have a little growing up to do when it comes to solving our fiscal problems. Too often we send conflicting signals to policymakers—on the one hand demanding that they shut down programs, stop the spending and cut taxes; but then on the other don’t end my favorite program, we need to spend more on [fill in your favorite government program here] and it’s ok to raise taxes on “them” as long as it’s not “us”. Moreover, when leaders take steps to make the hard fiscal choices and take the responsible steps to rein in government spending, we immediately play the zero-sum game of you can’t be a responsible steward of the people’s money and meet the basic needs of those most in need of help. Baloney!

My point is, leadership can and does make a difference when it comes to who pays and how much they pay. For example, the old shell game of holding the line on individual tax rates, but then nailing taxpayers indirectly through higher business taxes may make some in state and federal legislatures feel like fiscal giants, but, you and I know the hard cold reality: businesses don’t pay business taxes any more than houses pay property taxes. People pay taxes. And playing games with indirect business taxes is poor tax policy.

My point is, leadership can and does make a difference when it comes to who pays and how much they pay. For example, the old shell game of holding the line on individual tax rates, but then nailing taxpayers indirectly through higher business taxes may make some in state and federal legislatures feel like fiscal giants, but, you and I know the hard cold reality: businesses don’t pay business taxes any more than houses pay property taxes. People pay taxes. And playing games with indirect business taxes is poor tax policy.

The responsibility of those we elect to lead in times like these is to be an honest broker on our behalf. They must be fearless in enacting policies that encourage greater economic development and growth. They must be visionary in efforts to foster a climate that promotes job creation while at the same time remaining responsive to the welfare of those often left behind as growth takes hold.

When I was Lt. Governor of Maryland, I believed I was elected to serve the people. I was their public servant. I was entrusted with the duties and responsibilities necessary to make government work for the people. Marylanders paid their taxes into a system and it was my job to make sure the system, in turn, delivered a return on that investment. In short, it had to work for them.

And, we all know the “system” is working when it is built to create real opportunity and empowerment – the cornerstone of the “American Dream.” This is what makes our states and our country a leader, a beacon, like no other in the world.

Public policies should encourage growth and prosperity for businesses, for families and for individuals. Such policies should reflect our values and priorities as a nation. But in order to achieve this ideal, it’s time reform the way we do business.

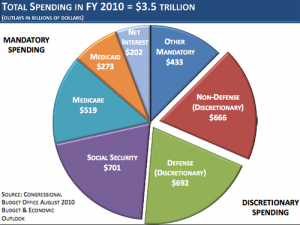

We already know roughly 30 percent of federal spending is discretionary, split about evenly between defense and domestic discretionary items. Defense spending should no more be exempt from rigorous fiscal scrutiny than domestic discretionary spending. But restraining domestic spending, while critical, is not enough. We can’t deal with our budget problems without addressing the 70% of spending that is mandatory. And that means entitlements, beginning with social security, Medicare, and Medicaid.

We already know roughly 30 percent of federal spending is discretionary, split about evenly between defense and domestic discretionary items. Defense spending should no more be exempt from rigorous fiscal scrutiny than domestic discretionary spending. But restraining domestic spending, while critical, is not enough. We can’t deal with our budget problems without addressing the 70% of spending that is mandatory. And that means entitlements, beginning with social security, Medicare, and Medicaid.

In short, everything—from taxes to entitlements—has to be on the kitchen table.

Just as my mother struggled to make ends meet for our family, almost every family in the nation has to live on some kind of budget. Many of those households are having that kitchen table meeting where the family comes together to discuss how to afford sending kids to college, or buying a new refrigerator, or just making it from one paycheck to the next.

Just as my mother struggled to make ends meet for our family, almost every family in the nation has to live on some kind of budget. Many of those households are having that kitchen table meeting where the family comes together to discuss how to afford sending kids to college, or buying a new refrigerator, or just making it from one paycheck to the next.

At that kitchen table, priorities are defined and costs are charted. This is the reality each one of us faces and it is only reasonable to expect the same from those who run our government.

Political leaders must commit to proposing common-sense budget plans that deal honestly with spending, saving and investing priorities just like the rest of us. The men and women we elect tomorrow must understand our needs today because they will be the architects of a new fiscal agenda for our nation.

It’s no secret that taxes and spending are a function of government, but it is the job of leaders, as public servants, to make sure our spending and tax policies are also a function of a thoughtful and deliberative process reflective of our values and priorities. That is why it is so critical that as we head into the debate on the debt ceiling, the debate on the budget, the debate on spending and taxes that don’t forget to enact common sense solutions and reforms that reinforce our commitment to families and the poor; and to the kind of financial stability that can be passed down from one generation to the next.

What we do in the next 12 months will define the 21st century for this generation; and those decisions will be the strategic link in either creating legacy wealth or a legacy of continued debt and poverty.

So we must act now—for ourselves and our families, but also for that little thing called the American Dream. Our tax, spending and fiscal policies can no longer interfere with that dream. Instead, they must underscore our shared vision and act as a foundation in the development of our shared prosperity—not its deterioration—by growing small businesses, by making affordable health care a reality and by fostering an environment in which competition and innovation flourish.

So we must act now—for ourselves and our families, but also for that little thing called the American Dream. Our tax, spending and fiscal policies can no longer interfere with that dream. Instead, they must underscore our shared vision and act as a foundation in the development of our shared prosperity—not its deterioration—by growing small businesses, by making affordable health care a reality and by fostering an environment in which competition and innovation flourish.

No people can prosper when its leaders believe the way to empowerment lies not in the advancement of the individual…but in the promotion of an opportunistic government. We must not lose sight of the immediate future, or of the real and tangible advantages that come from programs that operate within the context of sound fiscal and tax policies and a balanced national budget.

The old rules no longer apply…and that’s a good thing for our kids.

Leave a Reply