By Patrick Derocher, on Mon Jul 25, 2011 at 4:00 PM ET President Obama endorsed Harry Reid's $2.7 trillion budget plan over John Boehner's today. It’s been a busy day for debt and budget negotiations in Washington, enough to justify a second round of budget crisis updates from The Recovering Politician:

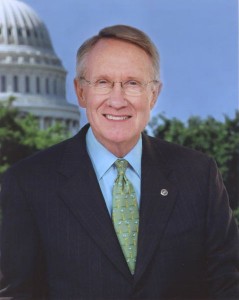

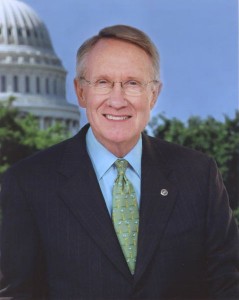

President Obama has endorsed Harry Reid’s plan to cut $2.7 trillion from the budget without raising revenues, a major departure from his earlier insistence that any debt deal include significant revenue increases, though the Reid plan does fulfill his desire to have the debt ceiling raised enough to get the US through the 2012 election cycle. White House Press Secretary Jay Carney praised the plan for cutting responsibly and removing default-related uncertainty from the coming year. [Politico]

Speaker Boehner has released the details of his debt-reduction plan to House Republicans. The proposal includes a two-step process that will cut spending by $3 trillion over the next ten years without raising taxes. It also includes the temporary debt ceiling increase that President Obama and Congressional Democrats have balked at in the past. [The National Review]

The International Monetary Fund has weighed in on the United States debt crisis, echoing the sentiment that getting spending under control, and more immediately, raising the debt ceiling, are necessary for the continued economic health of the US and the rest of the world. The IMF supported proposals that include spending cut and revenue increase triggers should Congress fail to act in a timely manner. [The Hill]

In spite of extensive testimony to the contrary, Representative and candidate for President Ron Paul has said that a default is the best thing that could happen to the United States. He cites past credit defaults as evidence that a default in 2011, though harmful to the US economy, would not be calamitous. [National Journal]

The Boehner budget proposal is being referred to as a victory for the Tea Party, since it includes no revenue increases, a two-tier raising of the debt ceiling, and a vote on a balanced budget amendment. Though not a complete rehash of the Cut, Cap, and Balance bill, this budget would require a vote on a Constitutional amendment during 2012. [Huffington Post]

Massachusetts Democratic Representative Edward Markey has accused House Republicans, and Speaker Boehner in particular, of trying to harm the US economy in hopes of pinning the blame on President Obama. [The Hill]

Democratic sources have confirmed that Harry Reid’s $2.7 trillion deficit reduction plan does not touch entitlement benefits in any way. This further differentiates his plan from Speaker Boehner’s and is likely to shore up support among Democrats who were unhappy that President Obama had expressed a willingness to put entitlement programs on the table as part of a debt deal. [Huffington Post]

Still confused as to what all of this means? Want to find out how you can have your voice heard on this issue? Click here to read The RP’s “Debt Ceiling for Dummies.”

By Grant Smith, RP Staff, on Mon Jul 25, 2011 at 3:30 PM ET

Google faces increased scrutiny over web reviews. [The Financial Times]

Using the internet is changing how our memory works. [The Toronto Sun]

What was Google thinking when they deleted some accounts on Google+? [ZDNet]

The confidence game going on with Google+ [New York Times]

By Zack Adams, RP Staff, on Mon Jul 25, 2011 at 3:00 PM ET

Here is a simply amazing video of a super-lightweight robot imitating a bird’s flight by flapping its own wings. A must-see. [TED]

A recent study claims that internet movie pirates are actually better consumers for the movie industry than non-pirates. the pirates typically buy more DVDs and visit movie theaters more often. [Geek.com]

A fantastic editorial on the unfortunately common practice of data-capping. “Caps should not just be a way for Internet providers to extract monopoly rents.” I couldn’t have said it better myself. [NY Times]

Here is another interesting article that explains how wider WiFi ranges (up to 45 miles) are possible using lower power consumption. [Clean Technica]

By Robert Kahne, RP Staff, on Mon Jul 25, 2011 at 2:00 PM ET This is how it all began. To me, Harry Potter and the Deathly Hallows was on one hand impossible to make while simultaneously extremely easy to make. It was easy to make because in JK Rowling’s book, she tossed up several action sequences which begged to be made into incredibly suspenseful and intense action sequences in a hugely-budgeted film. On the other hand, this movie was impossible to make because given the source material, the film makers were hard pressed to give this series the ending it deserved. What I mean by that is this: JK Rowling’s final book roundly failed to deliver the closure for which fans of the series begged. She randomly and emotionlessly killed off major characters and failed to provide the “big 3” with the large scale resolution wanted, and at no point provided a satisfactory conclusion to the story of Albus Dumbledore. Given this, the film makers had to create something that was satisfying in a filmographical sense which failed on a literary level.

Wait, THAT GUY used to be the dorky guy from the first movie? As far as the good moments went, I felt like the film did a fantastic job. When I read the book, I thought four scenes were developed especially for the film adaptation: Malfoy Manor, the robbery of Gringotts, the sacking of Hogwarts, and the scene at King’s Cross. The only scene of these which took place in Part I was Malfoy Manor, and I thought that scene was far and away the best in the film. The remaining scenes, which took place in Part II, were riveting, and provided more satisfaction (due entirely to visuals: the book was a template for a film rather than a true literary experience, IMO) than the book. I don’t want to give anything away, but suffice it to say that Neville Longbottom seemed far more heroic in the film than in the book.

As far as the difficult pieces, the film did a decent job. The ending of the book was laughable, if not down-right aggravating. I can remember reading the book and trying to muster up some tears for the ending of this series, which had spanned my entire childhood, and failing to do so. The film was not heart-wrenching, but given the source material, I felt relatively invested in the ending–more so than I did in the book. It is a shame that Ms. Rowling failed to adequately develop characters such as Ginny Weasley and Tonks, it is too bad that she killed off major characters without much fanfare, and it is too bad that she felt it necessary to murder the comic relief (seriously, if JRR Tolkien had murdered Pippin, we would have skewered him too). In parts, the film seems to mock the book’s ridiculous twists by giving slight references to major deaths.

In the end, if you are a fan of the series, seeing this film is necessary. Ms. Rowling and her compatriots at Warner Bros. have woven an amazing portrait of characters and situations which yearns for closure. It is a shame that the resolution they provide is so lacking–but it is what we have. If you, however, have not read the books or seen any of the films to this point, avoid this film. It is “Part II” of film which is the 7th part in a 7th part series. If you are unfamiliar with it, you will be entirely lost. And in addition, it isn’t all that great.

There is no way that those pictures are of the same person. I wish I could chalk all this pessimism up to the fact that I am a 24 year old man watching a film made for children–but I can’t. Rowling’s work has been praised for its accessibility to audiences of all ages. The most tragic part of the conclusions to this series is that we know–down in the depth of our souls–that Rowling had the story-telling talents to give us an incredible conclusion to an amazing series, and failed to do so. It was my great hope in 2007 that she would write us another novel from the perspective of Neville Longbottom about this time period. However, as it becomes less and less likely that Ms. Rowling will ever write another novel, and that the resolution we have is the only one we will ever get, it makes me a little sad.

This has been cross posted from my personal blog, which you can find here.

By Sandra Moon, RP Staff, on Mon Jul 25, 2011 at 12:00 PM ET

The Bible as Myth–one writer explains why reading the Bible in this light has been helpful to his understanding of biblical stories. He explains that myths are not false stories, as the term is commonly understood, but that they are “a form of literature that expresses fundamental truths in a way that ordinary discourse is inadequate to describe.” [Huffington Post]

The cooperative effort between two denominations in one of the largest social service networks in the U.S., Lutheran Services in America, may come to an end over a difference in views on homosexuality and the authority of scripture. [Washington Post]

As the budget deadline approaches, faith leaders meet with Obama and ask, “What Would Jesus Cut?” [God’s Politics Blog]

Will the LGBT fight for equal standing under the law play a significant role in decriminalizing Morman polygamy? [Religion Dispatches]

By Patrick Derocher, on Mon Jul 25, 2011 at 11:00 AM ET  Senate Majority Leader Harry Reid has created the most recent effort at a budget deal that can pass both Houses of Congress and be signed by the President. In a Sunday afternoon conference call with House Republicans, Speaker Boehner urged his caucus to stand firm in budget negotiations while acknowledging that compromise and a bill that can pass both houses of Congress will be necessary. For their part, Democrats including President Obama, Senate Majority Leader Harry Reid, and Treasury Secretary Tim Geithner still refuse to accept a deal that includes only a short-term debt ceiling increase, which House Republicans continue to push. [National Journal]

Mark Warner has called for the Senate to vote on the budget reduction plan put forth by the Gang of Six, a bipartisan coalition of which he is a member. Since its release a week ago, the plan has largely fallen by the wayside in favor of dueling plans by House Republicans and Senate Democrats. The Gang’s plan, through cutting defense spending, reforming entitlements and closing tax loopholes, would reduce the deficit by $9 trillion over the next decade. [The Hill]

Facing a Republican Party that is unwilling to share its debt-reduction plan or get behind any existing plans, Harry Reid is drafting a plan that will cut the deficit by $2.7 trillion dollars. While the plan includes raising the debt ceiling through 2013, as President Obama and other Democrats have demanded, it trims the deficit without raising revenues, as Republicans have demanded. [Politico]

President Obama is refocusing his administration on bridging the gaps between Democrats and Republicans, a major theme of his 2008 campaign that may be used to boost his appeal to independent voters in the 2012 election. In particular, he is working to break the partisan logjam surrounding debt ceiling and deficit negotiations, a goal which, if achieved, would likely improve the President’s image as far as the economy is concerned. [Washington Post]

According to a poll by The Hill, US voters are highly skeptical about the ability of Congress and the President to reach a deal on the debt ceiling: 71% say that they have little or no confidence in the government’s ability to do as much. Among Democrats, 47% have some level of confidence that a deal will be reached, while only 11% of Republicans agree. A slim majority (51%) believe Congress is too unwilling to compromise, while 35% believe it is too willing to do so, with Republicans being more likely than Democrats and independents to believe that Congress is too willing to compromise. [The Hill]

Speaking on MSNBC this morning, New York Democratic Senator Chuck Schumer referred to Majority Leader Harry Reid’s plan as something that House Republicans should be able to get behind and end the stalemate over debt reduction plans. He lauded its extension of the debt ceiling through 2013 while noting that it meets the major Republican criteria of not raising revenues and having a 1:1 spending cuts to debt ceiling increase ratio. [Huffington Post]

The Dow Jones Industrial Average opened about 125 points (one percent) lower on Monday, reflecting skepticism about the ability of Congress and President Obama to reach a deal on the debt ceiling before August 2. This drop is in line with similar declines in Asian markets Monday, includingJapan’s Nikkei, which fell be 0.81 percent, and the Shanghai Composite, which closed down about three percent on Monday. As a result of the declines, economists in Asian countries have been calling on the United States to effect swift action on the debt question. Drops in European markets have been less marked; as of Monday morning on the East Coast, the SIX Swiss Exchange was down 0.25 percentage points while the FTSE in England had barely dropped, by about 0.01 percent. [Politico]

Speaking in the economic powerhouse city of Shenzhen, Secretary of State Hillary Clinton reassure Chinese officials that the American economy is sound and in no real danger of defaulting on its loans. In doing so, she stressed that the United States will not give up on its role as a major power in the Asian political and economic affairs. [Huffington Post]

Still confused as to what all of this means? Want to find out how you can have your voice heard on this issue? Click here to read The RP’s “Debt Ceiling for Dummies.”

By Patrick Derocher, on Sun Jul 24, 2011 at 2:00 PM ET Bipartisan meetings have failed to produce results on the debt crisis After President Obama’s emergency debt talks ended following less than an hour of debt negotiations, Sen. Reid and Rep. Pelosi expressed frustration with Republican leadership being unwilling to compromise on a long-term debt deal. This gives the parties involved increasingly little time to put together a package before Asian stock markets open for business Monday. [NY Times]

Speaker Boehner told House Republicans in a conference call Saturday that he wanted to have a plan in place Sunday afternoon to avoid disrupting trading in Asia. He has said that the plan will be similar to the failed Cut, Cap and Balance plan and stay away from Sen. McConnell’s plan that would have allowed the President to raise the debt ceiling himself. President Obama, along with Congressional Democratic leadership, continues to assert that he will not sign a debt ceiling increase unless it extends through the end of the 2012 election cycle. [Politico]

Setting a conference call for 4:30 this afternoon (Sunday), Boehner has said he plans to release a debt ceiling plan that he is willing to advance without Democratic support. The plan, which bears some structural resemblance to one proposed by Treasury Secretary Tim Geithner, would be a two-step process, involving a savings and tax cut package followed by entitlement reform. The parties are still in disagreement as to whether the debt ceiling should be raised enough to get through 2012, as the Democrats want, or in a two step process, which Boehner and other Republicans have suggested. [National Journal]

Stock and currency market watchers are on tenterhooks, waiting to see if and how recent progress (or lack thereof) in debt negotiations will affect financial markets, beginning in Asia around 5 p.m. on the East Coast. Secretary Geithner devoted time Sunday morning to warning of the possible repercussions of the lack of a deal, while some are accusing him of using scare tactics to back Republicans into a corner on debt negotiations. [Politico]

Although precise numbers are difficult to impossible to find, it is estimated that Republican-leaning groups are outspending their Democratic counterparts by a margin of between five and ten to one on television ads relating to the debt ceiling and deficit battles. Leading the pack is Crossroads GPS, the Karl Rove-founded conservative group that is spending some $20 million in July and August to run the ads. In comparison, Democratic group Patriot Majority USA is spending $225,000 to run ads in Nebraska, Missouri, and Montana. [Politico]

Confused about the debt ceiling debate? Want to learn how to have your voice heard? Click here to read the RP’s “Debt Ceiling for Dummies.”

By Patrick Derocher, on Sat Jul 23, 2011 at 11:03 AM ET  The RP's Budget Crisis Update In spite of the collapse of the most recent round of Obama-Boehner talks and the pursuant blame game, it appears that some major points of agreement have been reached, namely raising the Medicare eligibility age from 65 to 67 and slowing the growth of Social Security benefits. [Huff Post]

In related news, Pres. Obama has called an emergency meeting involving himself, Speaker Boehner, Sens. Reid and McConnell, and House Minority Leader Nancy Pelosi at the White House Saturday at 11 a.m. Boehner has said that he needs to have a bill in hand on Monday (and passed in the House by Wednesday [Politico]…in order to get the debt ceiling raised by the August 2 deadline [National Journal]…

…which may in fact be an August 10 deadline. Researchers at Barclays, noting that the Treasury has taken in $14 billion more and spent $1 billion less than expected since July 13, may not run out of money until about a week after the currently anticipated deadline. [Huff Post]

This summarizes the he said-he said back-and-forth over the collapse of Pres. Obama and Speaker Boehner’s debt talks. The President blames the Speaker for not taking the plan (“the tough thing, but the right thing”) to his caucus because of revenue-raising measures, while the Speaker blames the President for having “moved the goal post” and requesting $400 billion in additional revenue toward the end of the failed negotiations. [Politico & Politico]

This is, of course, the sort of behavior House Republicans (especially the Tea Party set and the freshmen) wanted to see out of Boehner. [Politico]

In something of a repeat from 2010, House Republicans, especially the leadership, are on the lookout for primary challenges from the Tea Party wing of the Republican Party. The fear is that house primaries will be ignored by the party mainstream, allowing right-wing ideologues to win primaries in solidly Republican districts. This has, of course, made Speaker Boehner’s job rather difficult as he tries to work out a debt-response plan that will be accepted by the Senate and President without putting members of his caucus in electoral peril. [Huff Post]

Debt negotiations have claimed their first victims: thousands of employees of the Federal Aviation Administration will be furloughed or asked to work without pay after Congress failed to reach a deal that would either give them a temporary funding extension (the 21st consecutively) or a permanent funding scheme of some sort. [Washington Post]

In an interesting twist, Grover Norquist has said that Republican lawmakers should increase the debt ceiling to avoid the US defaulting on its obligations next month. Additionally, and perhaps more astonishingly, he has endorsed Senate Minority Leader Mitch McConnell’s “Plan B” legislation that would give President Obama the power to raise the debt limit as he sees fit. Norquist made news a few days ago when he said that letting the Bush tax cuts expire would not violate his anti-tax pledge that most Republican lawmakers have signed. [Roll Call]

In a reversal of their skepticism last week, Senate leaders have expressed willingness to consider the proposals made by the Gang of Six after Tom Coburn rejoined the group. Sen. McConnell: We wanted to give them an opportunity to make their suggestions about how their recommendations fit into the endgame here, and we had a good discussion.” Members of the Gang have expressed uncertainty about whether their plan will be the template for the eventual debt-reduction plan, but a willingness to work through the negotiations. [Politico]

By Grant Smith, RP Staff, on Fri Jul 22, 2011 at 4:00 PM ET

President Obama and House Speaker Boehner are said to be closing in on a $3 Trillion dollar deal. [Washington Post]

Even an MBA degree from a prestigious university may not protect you from the next round of layoffs looming over the financial sector. [CNBC]

Social networking for job-seekers: the next big thing? [Fortune]

What makes a great and innovative CEO? Learn from some of the best by reading here. [Forbes]

Why investors should be bullish on stock right now. [The Street]

By Stephanie Doctrow, RP Staff, on Fri Jul 22, 2011 at 2:00 PM ET New studies show that the taller a woman is, the more likely she is to develop certain kinds of cancers. Being short might not be such a bad thing! [Time]

Think you’re brave? You’re not embarking on an 103-mile swim from Cuba to Key West through shark-infested waters. [NY Times]

Zumba and other giant fitness classes are the newest trend in wellness. [Washington Post]

Don’t trust the calorie counts on restaurant menus. You might be eating more than you think you are. [Wall Street Journal]

Check this out for a good laugh: 15 health-related headlines that make you say “duh!” [Huffington Post]

|

The Recovering Politician Bookstore

|