After 10 days of discussing women and the role of women in the home, the workplace or just about any other space you could think of, a number of friends began to boast (or lament) about the presidential election turning on “social issues.”

After 10 days of discussing women and the role of women in the home, the workplace or just about any other space you could think of, a number of friends began to boast (or lament) about the presidential election turning on “social issues.”

No doubt such issues are important and will be as much a part of our national debate as health care or the War on Terror. But there is one issue, perhaps not as politically hot as contraceptives but just as potentially life changing: $5 trillion! That’s a number that doesn’t roll trippingly off the tongue too often, but that’s how much the federal debt has increased since January 2009.

To be certain there have been a lot of fingers in that pot to make it grow to be as big as it is.

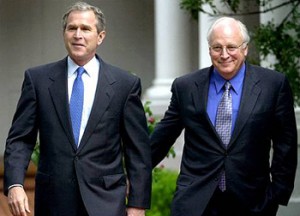

During the course of the Bush administration Republicans found their mojo for Big Government Republicanism. For example, in 2003, President George W. Bush announced his administration would spend “up to $400 billion” over 10 years to add prescription drug coverage to Medicare.

During the course of the Bush administration Republicans found their mojo for Big Government Republicanism. For example, in 2003, President George W. Bush announced his administration would spend “up to $400 billion” over 10 years to add prescription drug coverage to Medicare.

Problem was by 2008, that Medicare drug entitlement program was projected to cost $783 billion over the next 10 years. And then there was the $700 billion Troubled Asset Relief Program (“TARP”) from which funds were used to bail out the banks and General Motors. As Rep. Tom Price (R-Georgia)noted at the time, “It is now clear that the creation of TARP was a rueful mistake which has failed to provide urgent market stability, yet has put our country perilously in debt for the foreseeable future.”

Overall, under Republican leadership, federal spending surged 47 percent between 2001 and 2008, with spending increasing 9.1 percent (or $249 billion) in 2008 alone; while the federal debt rose by $3.8 trillion during that same period.

But not to be outdone, President Obama kicked off his term with an $823 billion “stimulus” from which we have still not seen the level of job creation needed to get the country back to work (it isestimated that the U.S. economy needs to create 208,000 jobs per month in order to return to pre-recession employment rates — by 2020!)

Moreover, under a Democrat-controlled White House, House and Senate we witnessed the number of employed persons (you remember them) decline from 145.3 million (the month before Obama was sworn in) to under 141.6 million today. And while the economy has seen a decrease in the unemployment rate (now 8.2%), it has also seen an increase in the rate of federal spending.

As the Congressional Budget Office predicted, since 2009 federal spending has averaged 24.4 percent of gross domestic product (“GDP”) — meaning, as the Wall Street Journal has pointed out, that one dollar of every four you produce from your labor is taxed and redistributed by the federal government. But in order to spend, the president has had to borrow money. And lots of it.

On Inauguration Day 2009, the nation’s debt stood at $10.6 trillion. Today it stands at $15.6 trillion. A $5 trillion increase. What makes this number even scarier is it does not include the promises made to social security and Medicare recipients, or the pensions of federal workers ($50.5 trillion); unfunded pensions for state and local government workers ($4.4 trillion), or the $11.4 trillion we owe on home mortgages, credit cards and auto and student loans.

Despite all of the current distractions — some important, others not so much — this fall’s presidential election will still be about our economy, your role in its recovery but more importantly the limits of our government and the direction this nation must take next for full recovery.

We have a $5 trillion sword hanging over our children’s heads and at some point we and this nation’s leaders had better figure out how to remove it. Ignoring a debt of this magnitude, or worse yet, feeding it through reckless spending policies allows it to consume both present and future generations of job creators and job seekers; and why would we want to consign our children to such a horrible economic fate?

Leave a Reply