Despite the recent GOP filibuster to block passage of the Buffett Rule in the Senate, the Whitehouse and the Democratic Party have vowed to continue the debate. While the proposal’s popularity does benefit President Obama in his bid for reelection, the Buffett Rule has merit because it is about fundamental fairness for taxpayers.

Despite the recent GOP filibuster to block passage of the Buffett Rule in the Senate, the Whitehouse and the Democratic Party have vowed to continue the debate. While the proposal’s popularity does benefit President Obama in his bid for reelection, the Buffett Rule has merit because it is about fundamental fairness for taxpayers.

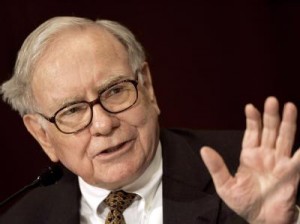

The Buffett Rule originated from Warren Buffett’s example of how the second richest man in the United States pays a lower tax rate than his secretary. Warren Buffett does not pay the bulk of his annual income in actual income taxes. Buffett only pays an effective income tax rate of about 15 percent because he is compensated in stocks from his company. Under the current system, an estimated 55,000 millionaires use this loophole in the United States to pay a lower tax rate than millions of middle class workers.

The proposed legislation stipulates that a taxpayer who earns at least one million dollars pay at least a 30 percent tax rate. Under the current system at least a quarter of all millionaires pay a lower tax rate than millions of middle class workers.

The proposed legislation stipulates that a taxpayer who earns at least one million dollars pay at least a 30 percent tax rate. Under the current system at least a quarter of all millionaires pay a lower tax rate than millions of middle class workers.

It is important to point out that the legislation does not raise the capital gains tax rate itself. The Buffett rule targets the loophole where individuals essentially make their annual income from capital gains, and in turn benefit from the lower rate of 15 percent. They include individuals who purposely choose to take compensation as stocks rather than salaried income, so that they will pay a lower tax rate than the rest of the people in their income tax bracket.

Opponents of the bill seem to dance around the issue to avoid addressing the matter of fairness.

Critics argue the Buffett rule will not solve the national debt. Proponents of the Buffett Rule did not claim this is a silver bullet for the deficit. Certainly every effort helps, but the main issue is that everyone should be contributing fairly to get our nation’s fiscal house in order.

Opponents also argue that the beneficiaries of the status quo pay more in total dollars than the average taxpayer the Buffett rule seeks to protect. It strains credulity to reason that a shift in tax rates affects a millionaire’s daily life more than it affects the working middle class.

Additionally, some small business owners and millionaires are taxed at a higher rate because although they earn the same income, their career does not afford them the benefit of compensation through stocks. Are those who succeed on Wall Street’s terms held to a different standard? In fairness to Wall Street, remember the Buffett rule does not change the capital gains tax rate itself.

The reason for the Buffet Rule’s popularity comes down to common sense about fundamental fairness. Is it too much to ask that people making over one million dollars in annual income pay a tax rate comparable to middle income Americans? Why is there one set of rules for millionaires and a different set of rules for the rest of us?

Leave a Reply